The 1099-NEC form for 2020 has brought significant changes for independent contractors and nonemployee compensation. This IRS form has replaced the 1099-MISC for reporting nonemployee compensation, making it crucial for individuals and businesses to understand its implications.

The Purpose of the 1099-NEC Form

The primary purpose of the 1099-NEC form is to report payments of $600 or more made to nonemployees during the tax year. This includes freelancers, independent contractors, and other self-employed individuals. By issuing this form, the IRS ensures that these individuals are properly reporting and paying taxes on their income.

The primary purpose of the 1099-NEC form is to report payments of $600 or more made to nonemployees during the tax year. This includes freelancers, independent contractors, and other self-employed individuals. By issuing this form, the IRS ensures that these individuals are properly reporting and paying taxes on their income.

Important Changes for 2020

Prior to 2020, nonemployee compensation was reported on Form 1099-MISC. However, starting from tax year 2020, the IRS has reintroduced Form 1099-NEC specifically for reporting nonemployee compensation. This change aims to make it easier for businesses to distinguish between different types of income.

Form 1099-NEC should now be used to report compensation paid to individuals who are not employees, such as independent contractors, freelancers, and consultants. It is important to understand that this form is separate from the 1099-MISC, which is still used to report other types of income, such as rents, royalties, and awards.

How to Complete Form 1099-NEC

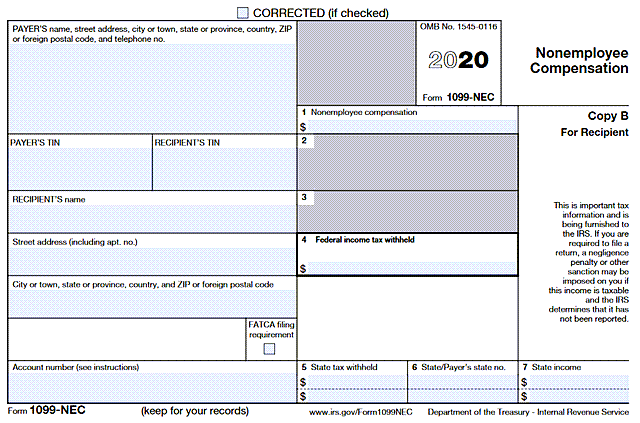

When preparing Form 1099-NEC, you will need to provide the recipient’s name, address, and taxpayer identification number (TIN). This can be their Social Security Number (SSN) or Employer Identification Number (EIN). You should also include your name, address, and EIN or SSN as the payer.

When preparing Form 1099-NEC, you will need to provide the recipient’s name, address, and taxpayer identification number (TIN). This can be their Social Security Number (SSN) or Employer Identification Number (EIN). You should also include your name, address, and EIN or SSN as the payer.

The form contains several boxes to report the income and any federal income tax withheld. Box 1 is used to report the total nonemployee compensation paid to the individual during the year. If you have withheld any federal income tax, you should enter that amount in Box 4.

After filling out the form, you will need to send Copy A to the IRS, Copy 1 to the recipient, and retain Copy B for your records. It is essential to ensure that all copies are sent to the appropriate parties by the designated deadlines to avoid penalties.

Implications for Businesses and Individuals

The introduction of Form 1099-NEC has important implications for both businesses and individuals. For businesses, it is essential to accurately report nonemployee compensation and ensure compliance with IRS regulations. Failing to report this income or misclassifying individuals can result in penalties and audits.

The introduction of Form 1099-NEC has important implications for both businesses and individuals. For businesses, it is essential to accurately report nonemployee compensation and ensure compliance with IRS regulations. Failing to report this income or misclassifying individuals can result in penalties and audits.

Individuals receiving nonemployee compensation need to be aware of their tax obligations. They should keep track of the income they received and report it accurately on their tax returns. Failure to report this income can lead to underpayment of taxes and potential IRS scrutiny.

It is advisable for businesses and individuals to consult with tax professionals to navigate the complexities of Form 1099-NEC. These professionals can provide guidance on proper tax reporting and help ensure compliance with IRS regulations.

Conclusion

The introduction of the 1099-NEC form in 2020 has brought important changes for businesses and individuals involved in nonemployee compensation. Understanding these changes and properly completing the form is essential to avoid penalties and ensure compliance with tax regulations.

By accurately reporting nonemployee compensation on Form 1099-NEC, businesses and individuals can contribute to the smooth functioning of the tax system while fulfilling their tax obligations. Seeking professional advice can further enhance understanding and help navigate any complexities that may arise.