When it comes to filing taxes, Asians residing in the United States have specific requirements and procedures to follow. One of the essential forms to fill out is the IRS Form 1040, also known as the U.S. Individual Income Tax Return. This form is used by individuals to report their income, deductions, and credits to the Internal Revenue Service (IRS) for taxation purposes. Let’s take a closer look at the Form 1040 and its various schedules that are relevant to Asian taxpayers.

Form 1040 - U.S. Individual Income Tax Return

The IRS Form 1040 is the standard tax form used by individuals to report their income and claim any deductions, credits, or exemptions they may be eligible for. It consists of several sections that help taxpayers accurately report their financial information. Asian taxpayers must carefully fill out this form, ensuring that all income from various sources is correctly reported.

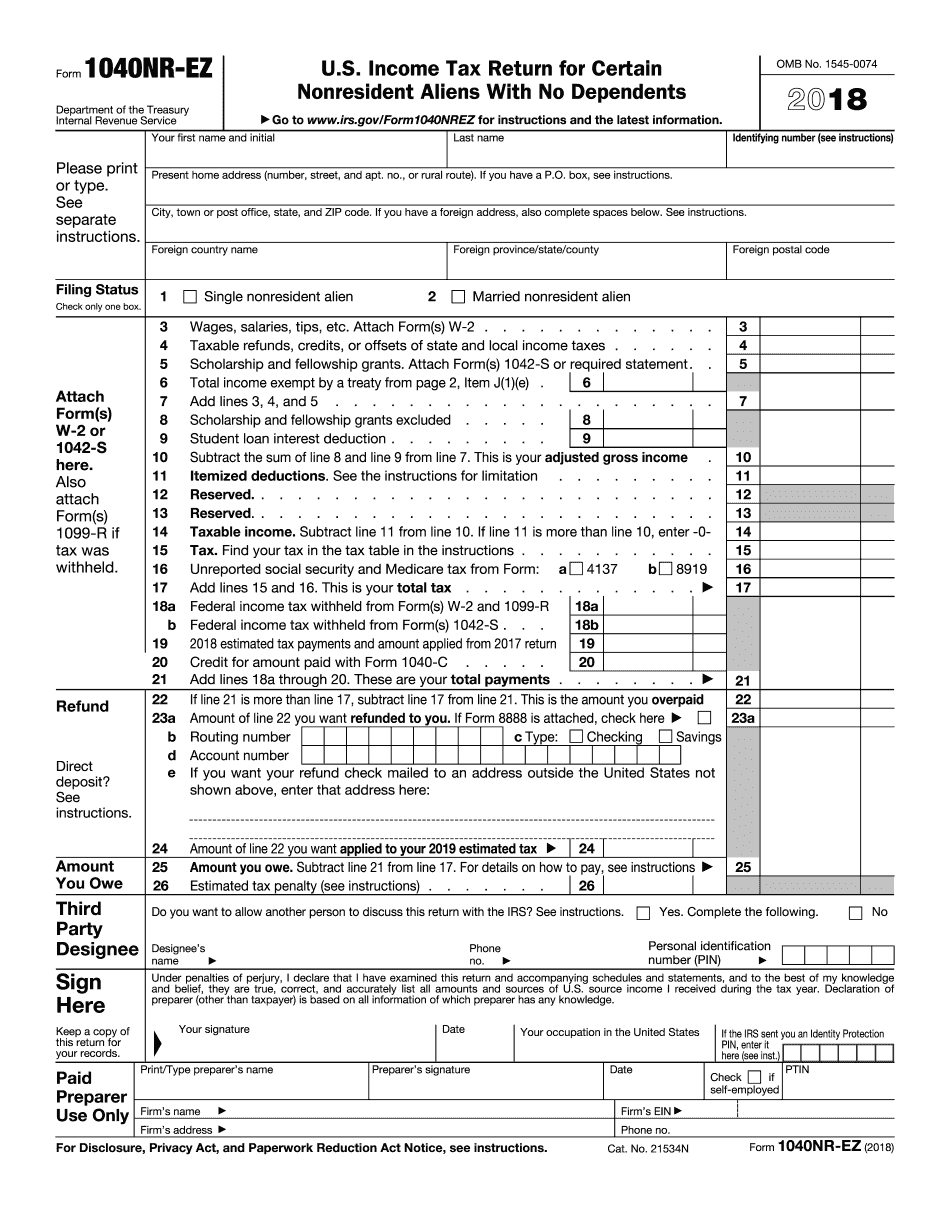

Form 1040 NR EZ - Nonresident Alien Income Tax Return

For Asians who are nonresident aliens in the United States for tax purposes, the Form 1040 NR EZ is the appropriate form to use. This simplified version of the form allows nonresident aliens who meet specific criteria to report their income and claim any applicable deductions or exemptions. Nonresident aliens must ensure they meet the requirements and accurately fill out this form, as it determines the amount of tax they owe or the refund they are eligible for.

For Asians who are nonresident aliens in the United States for tax purposes, the Form 1040 NR EZ is the appropriate form to use. This simplified version of the form allows nonresident aliens who meet specific criteria to report their income and claim any applicable deductions or exemptions. Nonresident aliens must ensure they meet the requirements and accurately fill out this form, as it determines the amount of tax they owe or the refund they are eligible for.

Schedule A - Itemized Deductions

Asian taxpayers who are eligible to claim itemized deductions rather than the standard deduction can utilize Schedule A. This form allows individuals to report various expenses such as medical expenses, charitable contributions, and state and local taxes paid. By carefully tracking and reporting these expenses, taxpayers may be able to reduce their taxable income and potentially lower their tax liability.

Asian taxpayers who are eligible to claim itemized deductions rather than the standard deduction can utilize Schedule A. This form allows individuals to report various expenses such as medical expenses, charitable contributions, and state and local taxes paid. By carefully tracking and reporting these expenses, taxpayers may be able to reduce their taxable income and potentially lower their tax liability.

It is important for Asian taxpayers to keep in mind that the tax code is complex, and it is often beneficial to seek assistance from a qualified tax professional or use tax preparation software that guides them through the process. Filing taxes accurately and on time helps ensure compliance with tax laws and avoids penalties or unnecessary audits.

In conclusion, understanding and properly completing the IRS Form 1040 and its relevant schedules is crucial for Asians living in the United States. By accurately reporting their income, deductions, and credits, individuals can fulfill their tax obligations and potentially minimize their tax liability. As tax regulations and forms may change from year to year, it is essential to stay updated with the latest information provided by the IRS or consult a tax professional for guidance.